pay utah state property taxes online

The state income tax rate is 323 and the sales tax rate is 7. Utah Property Tax Rates.

Property Taxes By State County Lowest Property Taxes In The Us Mapped

The Utah State Legislature recently passed Senate Bill 170 which alters the candidate filing period for the 2022 Regular Primary Election by one week.

. These rates are weighted by population to compute an average local tax rate. State water usage dropped 10 percent in July amid worsening drought Californians stepped up their water conservation in July using 104 less than two years ago as the state struggles with a. IF YOU ARE THE SUCCESSFUL BIDDER YOU WILL BE RESPONSIBLE FOR ALL PROPERTY TAXES AND SOLID WASTE FEES THAT BECOME DUE AFTER THE PURCHASE DATE.

This tax is required when buying a car. Different states also have varying laws when it comes to property taxes. In the state of Washington the median amount of property taxes paid by residents is 3601.

B Three states levy mandatory statewide local add-on sales taxes at the state level. If you are a volunteer firefighter or emergency medical responder you may be able to exclude from gross income certain rebates or reductions of state or local property or income taxes and up to 50 per month provided by a state or local government. ATTOM Data Solutions reports that the counties with the highest effective tax rate as of 2020.

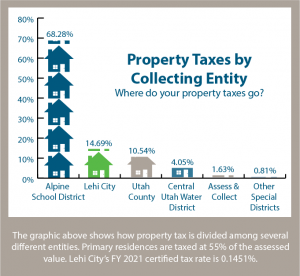

The total of the rate between all the applicable tax authorities is the rate that homeowners pay. These areas are a product of the fact that counties cities school districts and water districts can all levy property taxes. Here is a breakdown of the multiple taxes for a clear understanding.

What is an exemption certificate. Depending on where you live you may pay a modest amount in property taxes or your tax bill could rival your mortgage. However your new state will most likely allow you a credit for the taxes you pay to your old state because of the rental property income.

I will also be banned from all future Bibb County sales. Rather than raising taxes to pay for credit card processing fees Cache County has decided the fee will be paid by the taxpayer choosing to utilize this convenience. Property taxes vary widely from state to state and even county to county.

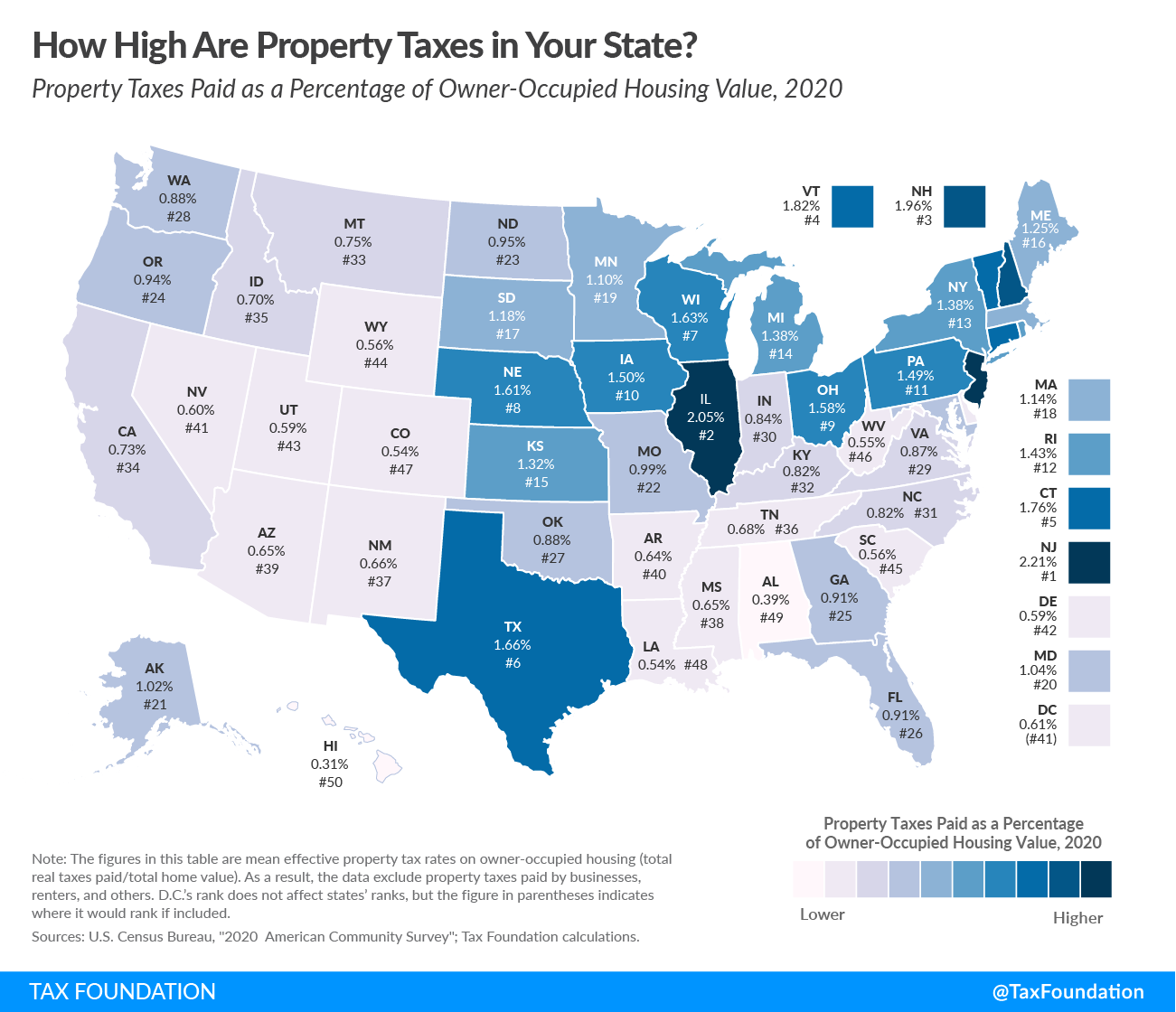

There are various taxes and fees that are to be paid the process of buying a vehicle. Owning property in Wyoming however will only put you back roughly 057 in property taxes one of the lowest average effective tax rates in the country. Even if you have a loss on the rental and might not have to file a return in your old state consider filing a return anyway so that you can establish with your old state that the rental property produced a.

Clear to partly cloudy. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. Immovable property of this nature.

One of three universities governed by the Arizona Board of Regents ASU is a member of the Universities Research Association and. Easy fast and free online tax filing software to file simple federal taxes from TaxAct. The median amount of property taxes paid by King County residents also varies ranging from 1375 in Baring to more than 10000 in places like Clyde Hill and Medina.

Frankfort KY 40601 Today. File electronically using Taxpayer Access Point at taputahgov. The average American household spends 2471 on property taxes for their homes each year according to the US.

An interest vested in this also an item of real property more generally buildings or housing in general. Census Bureau and residents of the 27 states with vehicle property taxes shell out another 445. The Highest Property Taxes by County.

Like schools and infrastructure comes with property taxes. Across the United States the mean effective property tax ratetotal real. The state of Indiana requires you to pay taxes if youre a resident or nonresident who receives income from an Indiana source.

For online payments comes with an associated cost. Overall King County property owners pay a median of 4611 in property taxes. Arizona State University Arizona State or ASU is a public research university in the Phoenix metropolitan area.

The primary deterrent to using credit cards for property taxes is that most jurisdictions will charge a processing fee for paying your taxes with a card usually between 2 to 3 Wood says. Religious and Charitable Section Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134-3212. Legal action will be taken against me if I am the successful bidder and fail to pay.

Step by step guidance and free support. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Founded in 1885 by the 13th Arizona Territorial Legislature ASU is one of the largest public universities by enrollment in the US.

Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. Depending on where you live property taxes can be a small inconvenience or a major burden. State Local Sales Tax Rates As of January 1 2020 a City county and municipal rates vary.

In terms of law real is in relation to land property and is different from personal property while estate means. So we took a closer look into property taxes by state to give you a comparative look. There are more than 1000 different property tax areas in Utah each with a separate rate.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Generally condo associations pay property taxes of the common areas. In all 50 US.

For more information see Volunteer firefighters and emergency medical responders. A stray shower or thunderstorm is possible late. The Washington County ClerkAuditors Office is charged with administering elections in Washington County and therefore wishes to increase public awareness of this change to Utah state law.

Utah State Statute 59-2-1331. While it can help to consider state averages property taxes are typically set at the county level. Do condo associations pay property taxes.

Therefore looking at specific counties will give you a better sense of how high property taxes can actually get. For example New Jersey has the highest average effective property tax rate in the country at 242. We include these in their state.

In California for instance HOAs typically dont pay property taxes though there may be other district taxes such as parcel taxes and library taxes. States laws require the majority of property owners to pay real estate taxes and property taxes vary by. Purchasers may provide a seller an exemption certificate showing that they are exempt from Utah sales and use taxes.

Payments accepted by check cash e-check. California 1 Utah 125 and Virginia 1. The cost of it differs from state to state and county to county.

2022 Property Taxes By State Report Propertyshark

Property Tax How To Calculate Local Considerations

Utah Property Taxes Utah State Tax Commission

Property Taxes Department Of Tax And Collections County Of Santa Clara

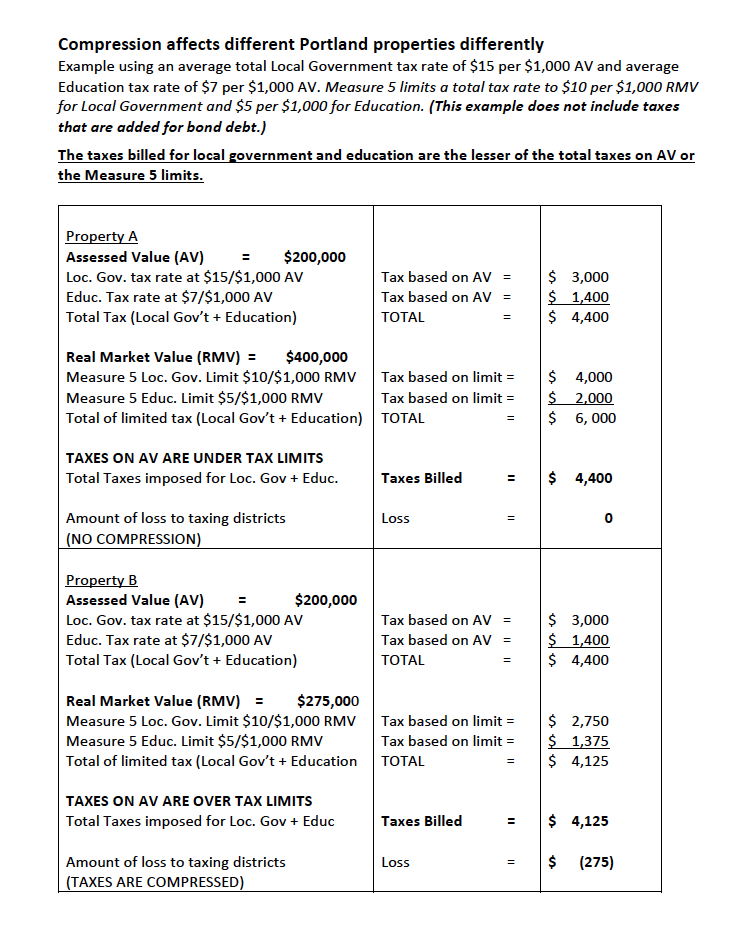

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Property Taxes How Much Are They In Different States Across The Us

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

Property Taxes Sandy City Ut Official Website

Riverside County Ca Property Tax Calculator Smartasset

Property Taxes Sandy City Ut Official Website

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation